Table of Content

If you’re hoping to buy a home in California, you’ll need to research the best mortgage rates statewide. Shopping around with multiple mortgage lenders will increase your chances of landing a great deal and a lower monthly payment on your loan for what could be many years. Estimated monthly payment and APR calculation are based on a down payment of 0% and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable.

We recommend that you reach out to at least 2 to 3 mortgage lenders for your refinance loan to ensure you get the best rate and pricing. Interested buyers should beware that all pricing and points are subject to change without prior warning. Thus, the rates displayed below are for informational reasons only and are based on the minimal prerequisites for purchasing real estate. Depending on the loan’s terms, market changes, and borrower’s credit, some rate and/or point revisions may be necessary. Additional limitations and conditions may be present as well. Before applying for a loan, check Colorado mortgage rates every day to be sure you’re getting the best offer possible.

Getting a mortgage in California

Two of those factors are the median home price and median monthly ownership costs for homes in California, which are significantly higher than the national average across the board. The state also has the 11th highest average cost of homeowner’s insurance, and when it comes to the cost of living, the state ranks as the 2nd most expensive, only after Hawaii. Getting a mortgage in California can be different from shopping for a mortgage in other states.

The average months of supplies are now 3, an increase from last year. Interest.com adheres to stringent editorial policies that keep our writers and editors independent and honest. We rely on evidence-based editorial guidelines, regularly fact-check our content for accuracy, and keep our editorial staff completely siloed from our advertisers. We work hard to ensure our recommendations and advice are unbiased, empirical, and based on thorough research. The average rate for a 5/1 ARM in California is 2.79% (Zillow, Jan. 2022).

What You Should Know About Buying a Home in California

Its important to keep these four facts in mind when you compare online mortgage rates.The rates listed are not quotes. A high credit score shows you pay your bills on time and/or use your credit responsibly. You are a lower risk of default when you have a high credit score and lenders reward you with lower interest rates.

For instance, your credit score is a major factor in determining the loan programs and interest rate available to you. Another factor you can control is the term length of your mortgage, but note that specific loans may only give limited options. Finally, whether the property will be your primary residence or an investment property will determine your mortgage rate and closing costs.

Mortgage options in California

Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. The products and offers that appear on this site are from companies from which Interest.com.com receives compensation. This compensation may impact how, where and in what order products or offers appear on this site. Interest.com.com does not include the entire universe of available financial products or credit offers.

Mortgage rates in Colorado are currently 4 basis points less than the 6.19% national average. The table below is updated daily with California refinance rates for the most common types of home loans. Atherton, CA — Housing, grocery and transportation costs in Atherton are all much higher than the national average. Housing is 55% higher than the national average, with a median home price of $537,872 and a median rent of $1,685. Some of the Services involve advice from third parties and third party content.

Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. As of Tuesday, December 20, 2022, current rates in California are 6.63% for a 30-year fixed and 6.02% for a 15-year fixed. Conventional mortgages are loans that conform to Fannie Mae and Freddie Mac underwriting standards. These are the most common mortgages that are not backed by the government.

These lower rates, he said, along with moderating home prices, should encourage more homebuyers to return to the market in early 2023. Homebuyers interested in obtaining a 30-year fixed-rate loan will fnd rates averaging around 6.347%, an increase of 0.076 percentage points from last Friday.The latest rate on a 30-year fixed-rate mortgage is 6.347%. The table below is updated daily with California mortgage rates for the most common types of home loans.

To receive the Bankrate.com rate, you must identify yourself to the Advertiser as a Bankrate.com customer. This will typically be done by phone so you should look for the Advertisers phone number when you click-through to their website. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. On November 23, 2022, the average Colorado mortgage interest rate will be 6.25%, which is a 10 basis point decrease over the previous week. The APR includes both the interest rate and the lender fees for a more realistic value comparison.

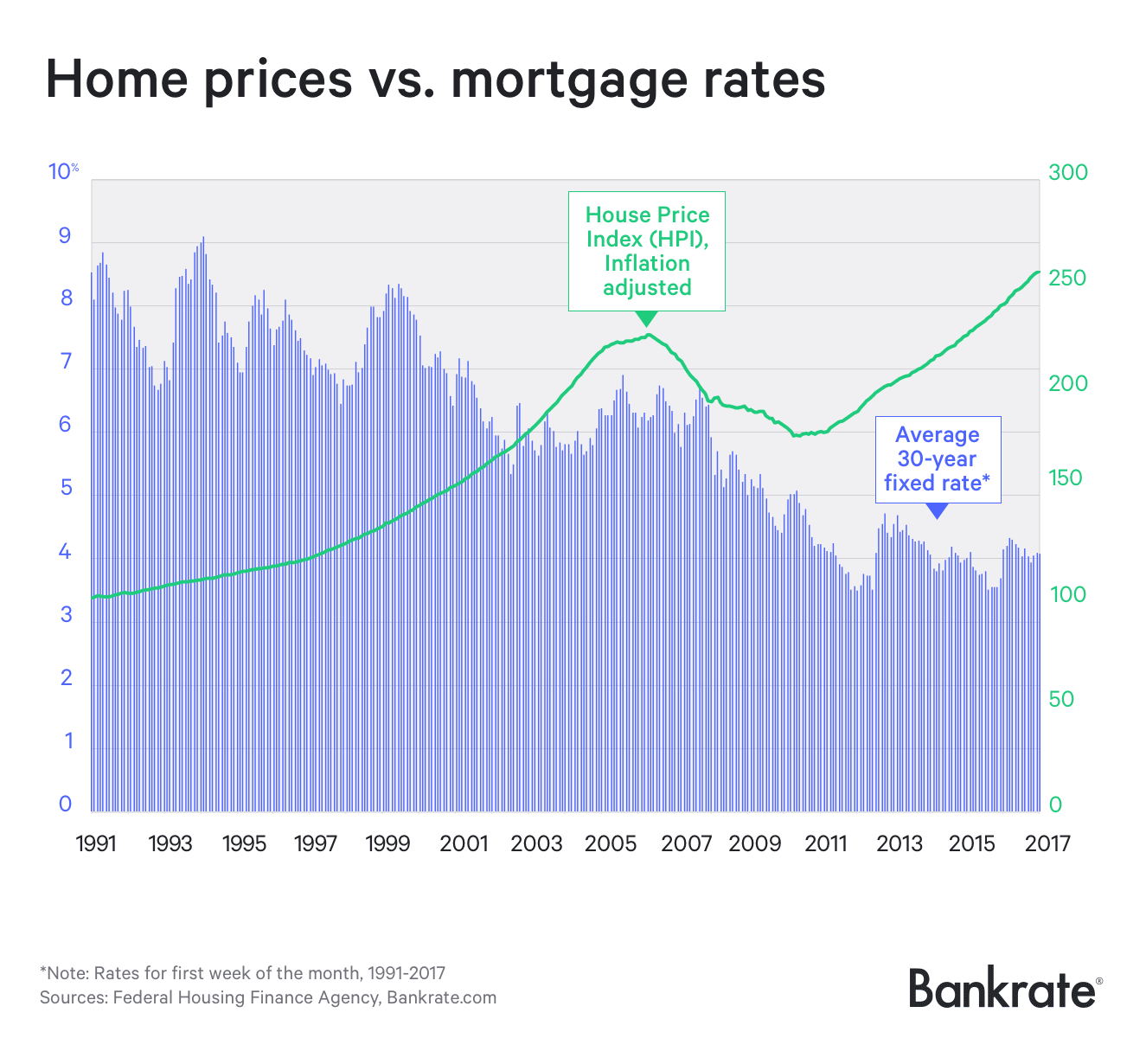

Its important to know that the mortgage industry does offer a wide variety of resources that are aimed at protecting the consumer. The three main organizations are the Consumer Financial Protection Bureau , the California Department of Real Estate and the Nationwide Mortgage Licensing System . Mortgage rates have surged since the start of 2022, which reflects investors views that the economy is too hot and that the Federal Reserve will take any necessary steps to cool it down and rein in inflation.

The interest rate on a mortgage is the cost of borrowing expressed as a percentage and applied to the loan’s principal. Based on this rate, the borrower’s monthly payment is calculated. Palo Alto, CA — Palo Alto, which is home to many tech firms, is not a cheap place to live. The cost of groceries in Palo Alto is 48% higher than the national average. The median home price in the city is $438,753 and the median rent in the city is $1,374 monthly. Use SmartAsset's mortgage rate comparison tool to compare mortgage rates from the top lenders and find the one that best suits your needs.

No comments:

Post a Comment