Table of Content

You always know exactly what your mortgage rate and monthly payment amount are since they never change. Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage loans.

Some of these programs include grants, no-interest deferred loans and financial assistance for the construction of accessory dwelling units . Money's Top Picks Best Personal Loans Over 170 hours of research determined the best personal loan lenders. Mortgage rates are currently 6 basis points less than the 5.55% national average rate. We will not sell your personal information but might offer an excellent rate every now and then on various ad platforms. But if you're still uncomfortable, you may opt out by using the link Do not sell my personal information. Mortgage rate locks occur when a lender agrees to cap the borrower’s interest rate while the loan application is being processed.

What You Should Know About Buying a Home in California

Before committing to an ARM it’s a good idea to calculate whether you could afford to pay the maximum interest rate allowed under the proposed loan terms. We’re guessing you wouldn’t want to be stuck with unaffordable monthly payments after your mortgage rate adjusts. Mortgage refinancing is a good option for lowering mortgage costs. The borrower can get the several benefits of refinancing if he knows the right time of refinancing.

Another notable feature of the California mortgage market is that when you take out a mortgage in California you’ll most likely get a deed of trust instead of an actual mortgage. Under California law, lenders who issue mortgages have to go through the judicial process to foreclose on the home that the mortgage applies to. But if the lender instead offers a trust deed, the lender can foreclose without the time and expense of going to court. The lender can initiate a power of sale foreclosure by hiring a third party to auction the home it wants to foreclose. The average cost of a 15-year, fixed-rate mortgage has also surged to 6.07%, compared to 2.43% in early January.

Home Equity Loans And Helocs In California

Right now, California property taxes are among the lowest in the country. According to the Tax Foundation, California’s property taxes were the fourteenth lowest in the U.S., with state and local property taxes amounting to $2,411 per capita. Money's Top Picks Best Credit Cards Cash back or travel rewards, we have a credit card that's right for you. First Time Homebuyer's Challenge Fast-track your home purchase with this Money challenge. Historical Mortgage Rates A collection of day-by-day rates and analysis.

Whether you’re ready to buy or refinance, you’ve come to the right place. Compare California mortgage rates for the loan options below. Information provided on Forbes Advisor is for educational purposes only.

Year Fixed Mortgage Rates in California

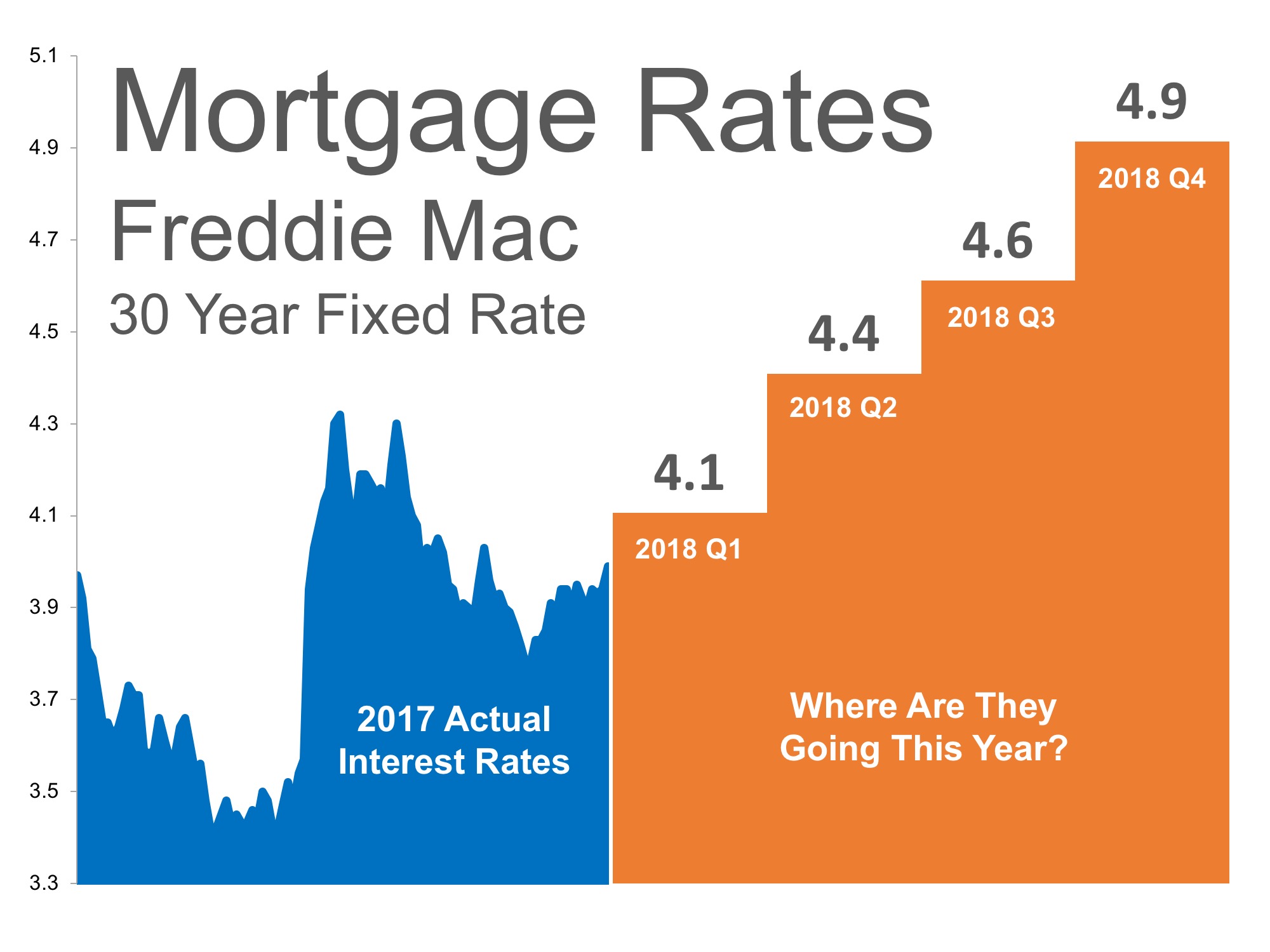

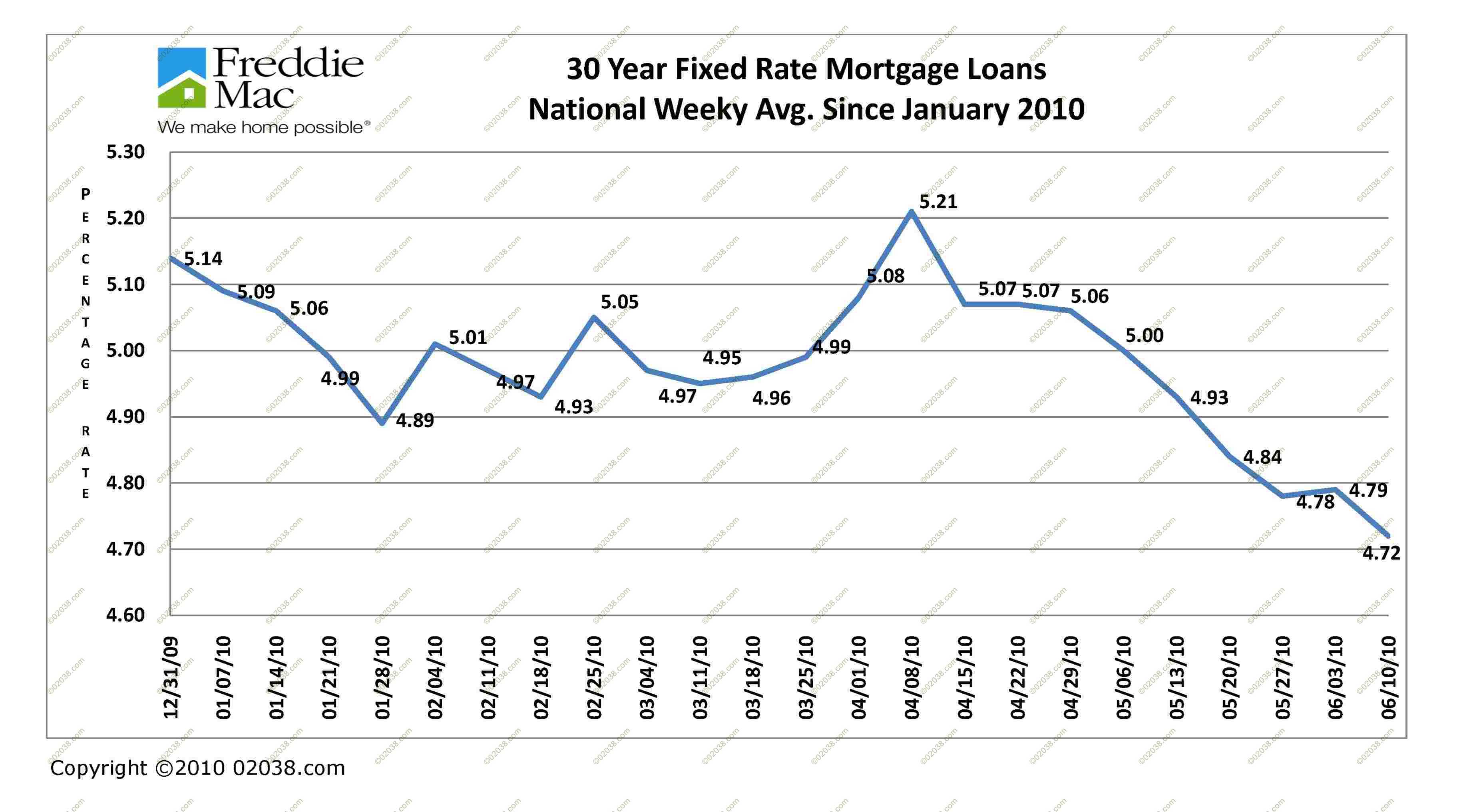

Shop around for a lender who will offer the lowest rate based on your credit score and debt-to-income ratio, and the one that charges relatively low fees. An adjustable-rate mortgage is when your mortgage rate and your monthly payment can adjust. Typically the rate and payment stay the same for a short period of time and then the rate and payment adjust every year after that. After hitting record lows in 2021, mortgage rates have risen sharply in 2022. The higher rate environment meanshousing affordability, already a challenge in California’s high-priced real estate market, presents an even higher hurdle. Use ERATE®'s rate chart to compare today's top rates in Oregon and find a lender that's the best fit for you.

Rates are at historic lows right now, so it could be worth it to switch your current mortgage for one with a lower rate especially if the new rate would be significantly lower. Refinance rates fluctuate, so the best time to refinance is when they reach their very lowest. Of course, it’s impossible to know in advance when rates are at their lowest. New Canadians and first-time homebuyers will drive demand for more housing, Laird said. The federal government is targeting 465,000 newcomers in 2023.

When Is The Best Time To Refinance To Get A Lower Rate

There are resources available to you if you need help with your California mortgage. If you need help buying your first home you can visit the State of California’s Consumer Home Mortgage Information site. The California Housing Finance Agency offers below-market interest rate programs for low- and middle-income first-time homebuyers applying for their first mortgages. There is also down payment assistance available to first-time homebuyers.

All of these factors should be weighed together to get an accurate picture of the costs and benefits — as well as the potential downsides — of buying in California. A financial advisor in Californiacan help you plan for the homebuying process. Financial advisors can also help with investing and financial plans, including tax, retirement and estate planning, to make sure you are preparing for the future. To find the best Home Equity and HELOC rates in California for you, you can enter your details in the rate quote form on this page and see rates from up to three lenders. The APR includes both the interest rate and lender fees for a more realistic value comparison. First-time homebuyers in California have access to assistance in the form of grants and programs.

If you’ve fallen behind on your mortgage and you’re at risk of foreclosure, you can visit the same site for resources for existing homeowners. If you qualify, you can get unemployment mortgage assistance, mortgage reinstatement assistance, principal reduction or transition assistance. You can also potentially lower your monthly payment through the Home Affordable Modification Program. That faster, easy-on-the-lender foreclosure process may sound like a borrower’s nightmare, but it’s worth noting that California is a non-recourse state. Say you take out a mortgage and then your financial circumstances change, leaving you unable to pay back that mortgage debt.

You agree that any such advice and content is provided for information, education, and entertainment purposes only, and does not constitute legal, financial, tax planning, medical, or other advice from Interest.com. You agree that Interest.com is not liable for any advice provided by third parties. To use some of the Services, you may need to provide information such as credit card numbers, bank account numbers, and other sensitive financial information, to third parties.

No comments:

Post a Comment